Graphs courtesy of Cannabis Benchmarks

Each autumn, Christmas comes a little early for cannabis consumers. Come Croptober, our bowls runneth over with the freshest ganja, scored for discounted prices thanks to a bountiful season.

During each cannabis harvest—which typically lasts from September to November—the market is traditionally flooded with hundreds of thousands (if not millions) of pounds of weed, causing prices to drop, and creating a market that’s ripe for buyers.

But not this year, according to a recent report by David Downs in Leafly, cannabis journalism pioneer, who writes that harvest discounts won’t be as plentiful for consumers in 2019.

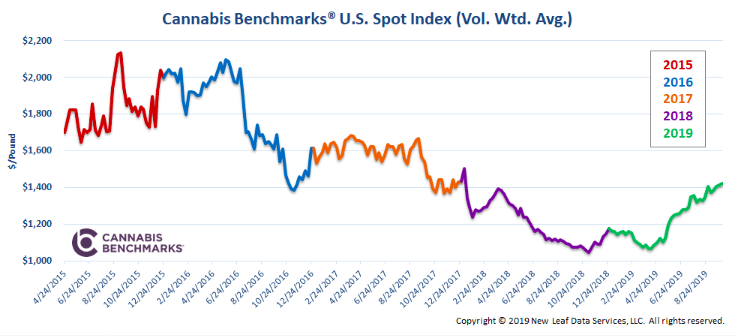

Data from industry analytics company, Cannabis Benchmarks, shows that the average price per pound of cannabis has steadily dropped since 2015, with the exception of a few price spikes along the way

In October 2015, the national average was $2,000 per pound; one year later (Oct. 2016), it fell to just under $1,400 per pound. In October 2018, prices dropped to just over $1,000 per pound.

This August, however, the average started to trend upwards—and farmers are hopeful. As of this summer, the per pound price increased to just over $1,400, and is expected to remain above $1,200 throughout the fall and winter months.

In an interview with Downs, Cannabis Benchmarks’ editorial director, Adam Koh, explains that when a high value crop like cannabis goes to market, “people are going to rush into the market to get in on the action.”

Koh continues, “When that happens, supplies increase, prices go down, and people go out of business; supply decreases and prices go back up.”

Cannabis Benchmarks tracks data from licensed medical and adult-use businesses in 17 markets. It also tracks the weekly, monthly and yearly U.S. spot—the (average) current market value—of wholesale outdoor, indoor and greenhouse grown cannabis.

As of October 18, 2019, the spot was $1,430 per pound, representing a new year-to-date high, according to the company’s U.S. Spot Index, which states, “This is the latest in the year that such a milestone has been established in the history of our reporting, a phenomenon that is especially notable as the autumn harvest has begun to be cut down and make its way to market.”

The company tracks the “big five” markets—California, Colorado, Nevada, Oregon and Washington—which drive nationwide prices during harvest, according to Leafly.

Legalization models in California and the 33 states throughout the U.S. with pro-cannabis policies have thrown a wrench into the ebb and flow of the industry—disrupting seasonal trends, and causing prices to, expectedly, be unstable.

There are lots of factors that influence the price of legal cannabis, including: state-specific policies, weather, the cost of production, regulation, taxation and more.

To oversimplify, it all comes down to the laws of supply and demand.

In states like Oregon, overproduction of the herb caused prices to drop to as low as $5 per gram. That was due, in part, to the state’s legalization model, which allowed for more than 2,000 cultivation licenses to be granted, according to The International Business Times.

The persistent price drops, molded crops and bad weather drove many out of the industry (or toward hemp), and helped to ease over supplies.

Additionally, the state Sen. Ron Wyden and Rep. Earl Blumenauer introduced legislation—the Wyden-Blumenauer State Cannabis Commerce Act—that would allow interstate commerce for legal cannabis businesses, reports Marijuana Moment. If passed, it would allow states like Oregon to export cannabis.

Many Oregon growers manufactured their supplies into concentrates, which have longer shelf lives. Thanks to the vape crisis, and a partial ban on vaping products in states like Oregon—the demand for flower may increase, bringing about a more homeostatic market.

For the first time since 2016, Oregon growers are seeing the wholesale price of flower increase. In fact, according to Marijuana Business Daily, the price of indoor-grown flower is up from $1,000-$1,500 per pound in 2018, to $1,800-$2,4000 this year.

In addition, MJ Biz Daily reports, wholesale marijuana prices have risen by: “100% in Oregon, 46% in Washington, 17% in Colorado.”

Californian growers are also experiencing wholesale price upticks, particularly for outdoor crops.

There are approximately 400 licensed retail shops in California, a state with a population of 40 million—home of the largest consumer market in the world. The potential is huge; but so is the disparity between consumers and storefronts—and the cost of production, compliance and launching a canna-business.

But weather in the state is said to have been ideal, allowing for robust harvests with potent, heavy buds. According to Downs of Leafly, that translates to a higher price gains this harvest. Plus, he adds, the addition of track and trace software in the state has “squelched the supply of unlicensed cannabis sneaking into the system,” also good news for the state’s legal market and it’s operators.

Despite a good season ahead in California, “demand could absorb increased supply,” reports Cannabis Benchmarks, pointing to the importance of market equilibrium. Ultimately, demand that outpaces the (legal) supply could cause a market shortage, which could influence product price points (perhaps evening drive consumers to the black market).

The average price per pound of flower has continued to go down since the 1990s. Whether the market is starting to stabilize in some states remains to be seen as the harvest makes its way to market, but some West Coast growers are hopeful.

Chiah Rodriques, co-owner of River Txai Farms and Arcanna Flowers, and co-founder of Mendocino Generations, says she’s starting to see more of a “leveling out” in the industry.

She expects greater price gains on products this winter versus last.

A second-generation cultivator, Rodriques was born and raised on a cannabis farm in Mendocino County, California where she still lives today.

“Pricing is one of the hardest parts of this lifestyle,” Rodriques explains, adding that she feels as if the historical price fluctuations during the rise and fall of the market has everyone on edge and uneasy about what’s to come.

“I am tired of playing this price is right game,” she says.

“We can’t live with $500 one day and $1,500 the next, while large corporations and brands eat off our plates,” Rodriques says.

“We don’t want to create a self-fulfilling prophecy by predicting price drops during flood of product availability,” she continues. “We want to find a balance, a level of comfort, or predictability, both for farmers, brands and consumers.”

She is optimistic prices will become more predictable, and that ultimately, “it will not be the only thing everyone wants to talk about during harvest and dry spells.”

“It is vital that we don’t rely on buyers or farmers to set prices alone. Farmers need a good price, but [it] needs to be reasonable to keep the flow of bulk and prepackaged branded product selling. We deserve a fair and good price.” Rodriques explains, “But holding out for the high might be the nail in your coffin. Letting things go at too low [of a rate] might cause a domino effect and give buyers ideas. Let’s be real; what are your costs? What is cannabis worth?”

Leave a Reply